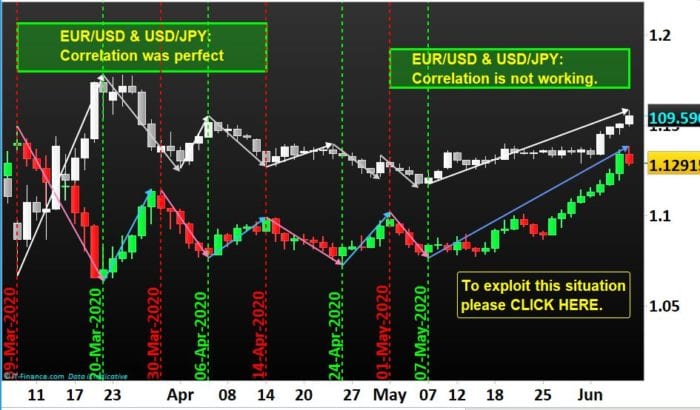

When Correlation does not work- what to do? Lets take this opportunity to explain like any other thing, Correlation does not hold good or it does not work all the 100% of the time as explained below. In this blog page we have analysed Correlation between 2 currency pairs viz. EUR/USD (EURO Dollar) in red and green candlesticks and USD/JPY (Dollar Yen) in white and grey coloured candlesticks for last 3 months period.

Correlation from 09-Mar-2020 to 20-Mar-2020: EUR/USD & USD/JPY were inversely Correlated. EUR/USD came down in price and USD/JPY went up at the same time. This means correlation between these currency pairs was correctly working during these days.

Correlation from 21-Mar-2020 to 30-Mar-2020: EUR/USD & USD/JPY were inversely Correlated. EUR/USD went up in price and USD/JPY came down at the same time. This means correlation between these currency pairs was correctly working during these days.

Correlation from 31-Mar-2020 to 06-Apr-2020: EUR/USD & USD/JPY were inversely Correlated. EUR/USD came down in price and USD/JPY went up at the same time. This means correlation between these currency pairs was correctly working during these days.

Correlation from 07-Apr-2020 to 14-Apr-2020: EUR/USD & USD/JPY were inversely Correlated. EUR/USD went up in price and USD/JPY came down at the same time. This means correlation between these currency pairs was correctly working during these days.

Correlation from 15-Apr-2020 to 24-Apr-2020: EUR/USD & USD/JPY were inversely Correlated. EUR/USD came down in price and USD/JPY went up at the same time. This means correlation between these currency pairs was correctly working during these days.

Correlation from 25-Apr-2020 to 01-May-2020: EUR/USD & USD/JPY were inversely Correlated. EUR/USD went up in price and USD/JPY came down at the same time. This means correlation between these currency pairs was correctly working during these days.

Correlation from 02-May-2020 to 07-May-2020: EUR/USD & USD/JPY were inversely Correlated. EUR/USD came down in price and USD/JPY went up at the same time. This means correlation between these currency pairs was correctly working during these days.

So from above discussion, we can observe that from 09-Mar-2020 to 07-May-2020 correlation between these currency pairs was correctly working as it is expected since in EUR/USD, US Dollar is the “term” currency and in USD/JPY US Dollar is the “base” currency.

But from 08-May-2020 till the time of writing this post (dated 07-Jun-2020) the Correlation between these 2 currency pairs are out of whack as EUR/USD is going up in price and USD/JPY is also going up at the same time. This means correlation between these currency pairs is not correctly working during these days.

Question is what to do now or how to handle this peculiar situation. Before we start exploiting this situation, we need to wait for a bearish bar for EUR/USD to close below the bullish bar printed on 03-Jun-2020 and its low should be taken out or a bearish bar for USD/JPY to close below the bullish bar printed on 05-Jun-2020 and its low should be taken out.

You must be wondering how you can take advantage of these potential price objectives in Forex EURUSD & USD/JPY in future the same way we took a huge points from the markets in the past till date as per our various Blog Posts.

To take your Forex Trading to the Next Level through all our professional approaches and to find out the answers to all your Forex Trading related queries, please contact us at 03 9015 4858 and book your FREE discussion session for 30 minutes at Level 3, 2 Brandon Park Drive, Wheelers Hill, Victoria 3150.

Learn how to trade Forex Pairs with us to explore the possibility of earning passive income keeping your day job.

Our Proprietary Forex Trading Strategy, which actually works, will guide you through every step of your trading in Forex Pairs and help you to explore the possibility of earning extra income. Learn what all other Forex Currency Pairs we are Trading in our Forex Trading Asset Classes. Develop yourself as a professional Forex trader capable of capturing second income in the future with us.

Please click on the Contact Us link: Goo.Gl/2SRZoG

Call us on +61 3 9790 6476

email: [email protected]

Our Blog Post dated Jun 30, 2017:

Take advantage of Currency Correlation, Pairs Trading and Dollar Neutral Hedge. Learn how to take advantage of Statistical Arbitrage in Correlated Currency Pairs like EURUSD, EURJPY, USDJPY & USDCHF.

Take your Trading to next level by exploring the idea of Pairs Trading.

To be able to Trade this Asset Class (Forex) and to take advantage of this impending move as it is happening NOW, join our “Professional Trader Development”.

Enroll now to take advantage. Please click on the Contact Us link: Goo.Gl/2SRZoG

Call us at +61 3 9790 6476; email: [email protected]

Useful Links:

—————————————————— MORE—————————————————————

On completion of the “Basics of Trading” course, You will develop an In-depth understanding of Fundamentals factors moving Markets. You will be able to clearly understand the Market Jargon e.g. Swaps, Spread, Slippage etc.

Start your Forex Trading with Partha Banerjee of N P Financials by doing one-on-one coaching

earn Trading from our A full-time Professional Trader. This is a step by step hand holding program designed keeping in mind your learning progression.

A full-time professional trader from NPF (Professional Proprietary Trading firm) will be your own personal coach for 3 months. It will give you twelve, one-on-one coaching sessions. You will be attending one monthly Seminar.

A full-time professional trader from N P Financials will be your own personal coach for 6 months. You will be introduced to our Proprietary Trading Edge. It will give you twenty-four, one-on-one coaching sessions.

A full-time professional trader from N P Financials will be your own personal coach for 9 months. You will be introduced to our Proprietary Trading Edges.

A full-time professional trader from N P Financials will be your own personal coach for 12 months. You will be introduced to our Proprietary Trading Edges.