Start trading like us (and not like the Redditors) and develop yourself to become an expert trader in Treasury Yield or any of the asset classes, you want to consider for buying or selling when you are trained by us.

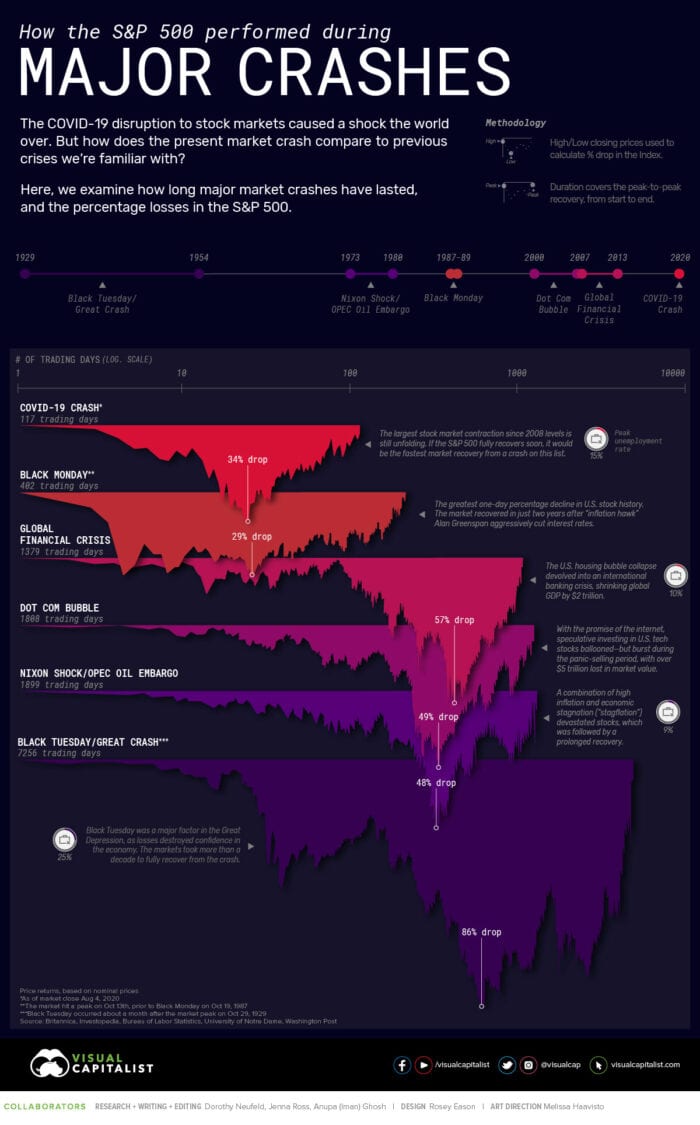

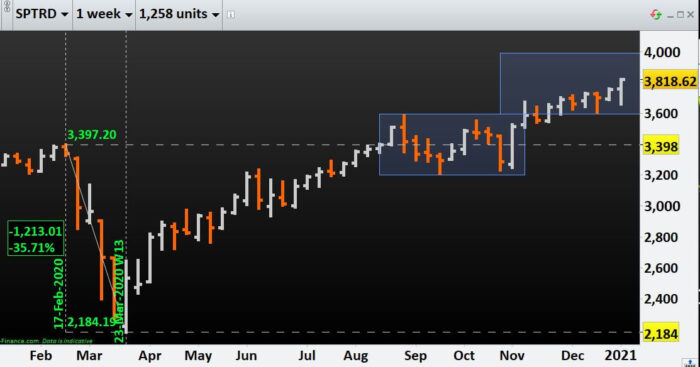

To know how to take advantage of our proprietary and predictive price analysis of the Index Trading, especially ASX Index (ASX200) and S&P 500, please join our Index trading desk. Know how to take advantage of the end of this shortest bear market.

Now you can learn how to trade all the Indices, especially ASX Index (ASX200) and S&P 500, with us to explore the possibility of earning passive income keeping your day job.

Our Proprietary Index Trading Strategy will guide you through every step of your trading in Index Trading, especially ASX Index (ASX200) and US Stock Market S&P 500, and explore the possibility of earning extra income. Learn what all other Indices we are Trading in our Index Trading Asset Class. Develop yourself as a professional trader capable of capturing second income in the future with us.

Please click on the Contact Us link: Goo.Gl/2SRZoG

Call us on +61 3 9790 6476

email: [email protected]

Start trading like us (and not like these redditors) and develop yourself to become an expert trader in any Treasury Yield or of the asset classes, you want to consider for buying or selling, when you are trained by us.

To know how to take advantage of our proprietary and predictive price analysis of the Index Trading, especially ASX Index (ASX200) and S&P 500, please join our Index trading desk. Know how to take advantage of the end of this shortest bear market.

Now you can learn how to trade all the Indices, especially ASX Index (ASX200) and S&P 500, with us to explore the possibility of earning passive income keeping your day job.

Our Proprietary Index Trading Strategy will guide you through every step of your trading in Index Trading, especially ASX Index (ASX200) and US Stock Market S&P 500, and explore the possibility of earning extra income. Learn what all other Indices we are Trading in our Index Trading Asset Class. Develop yourself as a professional trader capable of capturing second income in the future with us.

Please click on the Contact Us link: Goo.Gl/2SRZoG

Call us on +61 3 9790 6476

email: [email protected]

Start trading like us and develop yourself to become an expert trader in Treasury Yield or any of the asset classes, you want to consider for buying or selling, when you are trained by us.

To know how to take advantage of our proprietary and predictive price analysis of the Index Trading, especially ASX Index (ASX200) and S&P 500, please join our Index trading desk. Know how to take advantage of the end of this shortest bear market.

Now you can learn how to trade all the Indices, especially ASX Index (ASX200) and S&P 500, with us to explore the possibility of earning passive income keeping your day job.

Our Proprietary Index Trading Strategy will guide you through every step of your trading in Index Trading, especially ASX Index (ASX200) and US Stock Market S&P 500, and explore the possibility of earning extra income. Learn what all other Indices we are Trading in our Index Trading Asset Class. Develop yourself as a professional trader capable of capturing second income in the future with us.

Please click on the Contact Us link: Goo.Gl/2SRZoG

Call us on +61 3 9790 6476

email: [email protected]

5. According to https://www.forbes.com/sites/

- Stocks are still the place to be.

- The U.S. will not default on its debt.

- America will recover.

Start trading like us and develop yourself to become an expert trader in Treasury Yield or any of the asset classes, you want to consider for buying or selling, when you are trained by us.

To know how to take advantage of our proprietary and predictive price analysis of the Index Trading, especially ASX Index (ASX200) and S&P 500, please join our Index trading desk. Know how to take advantage of the end of this shortest bear market.

Now you can learn how to trade all the Indices, especially ASX Index (ASX200) and S&P 500, with us to explore the possibility of earning passive income keeping your day job.

Our Proprietary Index Trading Strategy will guide you through every step of your trading in Index Trading, especially ASX Index (ASX200) and US Stock Market S&P 500, and explore the possibility of earning extra income. Learn what all other Indices we are Trading in our Index Trading Asset Class. Develop yourself as a professional trader capable of capturing second income in the future with us.

Please click on the Contact Us link: Goo.Gl/2SRZoG

Call us on +61 3 9790 6476

email: [email protected]

Learn Share Trading with Partha Banerjee of N P Financials, the Prop Trading Firm at Melbourne

Learn how to Trade the Directional Share Market. Get mentored in the art and science of Share Trading in our proprietary 6 months developmental course. Derive benefit from our effective Share Trading Strategies.

On completion of the “Basics of Trading” course, You will develop an In-depth understanding of Fundamentals factors moving Markets. You will be able to clearly understand the Market Jargon e.g. Swaps, Spread, Slippage etc.

A full-time professional trader from N P Financials will be your own personal coach for 3-6 months. You will be trained on how to learn the Market Programming Language.

A full-time professional trader from NPF will be your own personal coach for 3-6 months. You will be trained on how to Develop your Market Scanning Edge.

A full-time professional trader from NPF will be your own personal coach for 3-6 months. You will be trained on how to Build your Trading Edge.

Start Share Trading with Market leaders at Melbourne, Australia.

N P Financials is a Traders Training Facility where we train newcomers as well as professionals on how to trade Forex, Shares, Commodities, Bond & Indices.Our preferred broker is GO Markets.