Australian stock market index now: an in-depth analysis by N P Financials.

In this blog post we will carry out an in-depth analysis of the Australian stock market index, ASX200. Let’s first know about the Australian stock market index, ASX200 and it’s history.

The Australian stock market index, ASX200 cash index is an important benchmark for investors and traders. It tracks the performance of the top 200 companies by market capitalization that are listed on the Australian Securities Exchange (ASX). The ASX200 cash index began in 2000 and is viewed as a barometer for the overall health of the Australian equity markets.

The Australian stock market index, is calculated based on a free-float adjusted market capitalization methodology. This means that only those companies with a publicly available float of shares will be included in the calculation of the index. Companies such as those with majority state ownership, private ownership or restricted securities are not included in this calculation.

To gain an Australian stock market index listing, all companies need three things: enough tangible assets to back their market capitalization; liquid funds ready for use and sufficient working capital. Lastly, they must submit financial statements and audit reports as a way of demonstrating these criteria have been met. Making sure you meet each requirement is the key to unlocking your place in Australia’s stock exchange!

Trading on the Australian stock market index, ASX200 cash index can be done through futures contracts or options contracts, all of which provide exposure to changes in the underlying index value without direct ownership of any particular stocks. Futures contracts are agreements between two parties to buy or sell an asset at a predetermined price at some future date, while options give buyers (and sellers) another way to gain exposure to movements in stock prices without needing to own any shares outright.

In addition, ETFs and CFDs (Contract For Difference) which track the Australian stock market index, ASX200 cash index also provide investors with various ways to invest and trade this important benchmark. These instruments allow traders and investors alike a very efficient way to take advantage of short-term movements in particular sectors within the wider Australian equity market without needing large amounts of capital up front.

When trading on the Australian stock market index, ASX200 cash index, there are several key factors that should be taken into consideration, such as sector composition and trading volume. Sector composition affects how large movements in one sector may affect other sectors within this important benchmark, while trading volume determines how much liquidity is available when executing trades quickly and efficiently at reasonable prices. Additionally, volatility should also be monitored closely when trading on this important benchmark as large daily swings can drastically affect positions held by traders if not managed correctly.

Overall, understanding and correctly utilizing these factors can help traders make more informed decisions when trading on this key benchmark for Australia’s equity markets – allowing them to capture potential opportunities while avoiding unnecessary risks associated with inadequate research and analysis.

Current analysis of Australian stock market index, ASX200:

Australian stock market index, ASX200 after recently retesting pre-GFC (Global Financial Crisis) high at 6,851.5 closed above the same level of 6,851.5 on Friday 04-November-2022. Next Tuesday 08-November-2022 price goes above the high (6,949.4) of the Friday 04-November-2022 bar. From then on there is no looking back.

Australian stock market index, ASX200 price is now trading at 7,368.9 price level. This level is just shy of the 78.6% Fibonacci level drawn from Monday 03-January-2022’s swing high to Monday 03-October-2022’s swing low.

If Australian stock market index, ASX200 price is closing above the level of 7,387.8 and its high is taken out then our targets are as below:

- 7,500

- 7,513

- 7,555

- 7,586

- 7,600

- 7,655

Else if Australian stock market index, ASX200 price is doing a crack and snap-back on the level of 7,387.8 and its low is taken out then our targets are as below:

- 7,353

- 7,300

- 7,282

- 7,250

- 7,210

- 7,200

- 7,139

- 7,037

We are always there to support you, when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram and Discord.

N P Financials Pty Ltd

Level 3, 2 Brandon Park Drive

Wheelers Hill, Victoria 3150

Phone: +61 3 9790 6476

email: [email protected]

Let’s chat https://discord.gg/5HkVUCk6KB

=================================================================================================================================

Factors influencing which shares to buy and when- an in depth analysis by N P Financials.

In this blog post we will analyse the current stock market worldwide. We will look at the factors that are influencing the market and offer our analysis on possibility of which shares to buy or consider buying and when.

There are a number of factors that are influencing the stock market at present. The first one is the inflation related worry. The Consumer Price Index for United States of America is 296.171 for the month of August 2022. The inflation rate year over year is 8.263% (compared to 8.525% for the previous month). This factor will highly impact on which shares to buy and when.

As we know, inflation is an economic phenomenon that affects different aspects of the economy in different ways including on which shares to buy and when. On the one hand, inflation raises prices, which lowers your purchasing power. On the other hand, it lowers the values of pensions and savings, and increases the variable interest rates on loans. Assets such as real estate and collectibles usually keep up with inflation. In this blog post, we will take a closer look at the effects of inflation on which shares to buy and when.

The second factor is the interest rate rise by the US Federal Reserve. When the Fed raises interest rates, it becomes more expensive for companies to borrow money. This can lead to slower economic growth and higher unemployment, as companies retrench in order to cut costs. In turn, this can lead to lower profits and lower share prices affecting our choice on which shares to buy and when.

That said, not all sectors will be equally affected hence our choice on which shares to buy and when. For example, companies in the consumer staples sector tend to be less sensitive to interest rate rises because people still need to buy food and other essentials regardless of the state of the economy.

On the other hand, sectors such as homebuilding and automobiles are more likely to be impacted because consumers are more likely to put off big-ticket purchases, like home buying, when interest rates are high. We will keep in mind this factor while analysing which shares to buy and when.

The 3rd factor is the ongoing trade war between the US and China. This has led to a lot of uncertainty in the markets and has resulted in a decline in share prices for many companies. This important aspect has to be kept in mind this factor while analysing which shares to buy and when.

So, which shares should you buy and when? Our analysis are as follows:

1. Tesla– Tesla share price is now interacting with the lows printed on the monthly chart on May’ 2022 (205.84) and June’ 2022 (208.70). Now if these lows are broken to the downside, we need to see whether it is bouncing from the lows printed on the monthly chart on March’ 2021 (179.85) and May’ 2021 (181.67). We will keep a close watch on how Tesla share price is interacting with these 4 lows to look for a buying opportunity in future. We will post then following this post of which shares to buy and when.

2. Apple – The iPhone maker has also seen its share price fall in recent months to 38.60% (at 132.88) from its high printed after Covid on January’ 2021 (182.62) but we believe it remains a sound investment. Apple is a cash rich company with a strong product lineup and we expect it to weather the current market conditions well if it is bouncing from our proprietary levels of 132.88 and 128.90 (low of June’ 2022).

We will keep a close watch on how Apple share price is interacting with these 2 lows to look for a buying opportunity in future. We will post then following this post of which shares to buy and when.

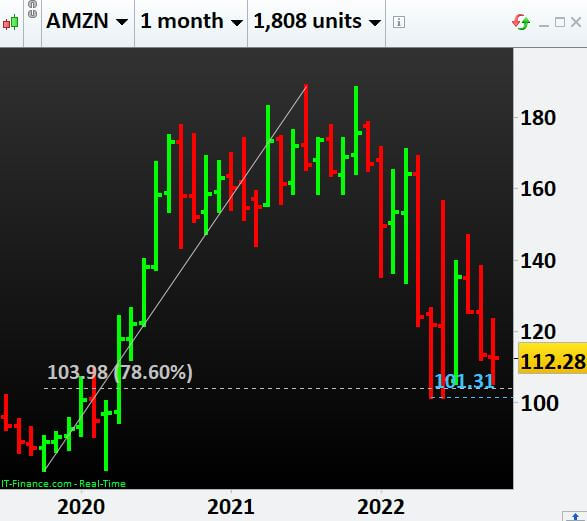

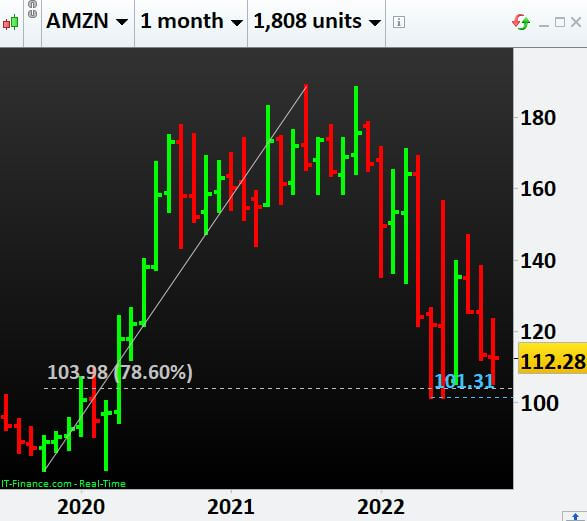

3. Amazon – The online retailer has seen one of the worst fall in its share price in recent years due to concerns about its profits. Its share price has fallen in recent months to 78.60% (at 103.98) from its high printed after Covid on July’ 2021 (188.65) but we believe it remains a sound investment.

We expect Amazon to weather the current market conditions well if it is bouncing from our proprietary levels of 103.98 and 101.31. We believe that Amazon remains a strong company with a bright future and its share price will recover in due course. We will keep a close watch on how Amazon share price is interacting with these 2 lows to look for a buying opportunity in future. We will post then following this post of which shares to buy and when.

4. Alphabet (Google) – The share price of Alphabet Inc is now interacting with the 38.20% (at 96.79) Fibonacci level drawn from the swing low of the year 2008 to the high of the current year. However, we believe that Alphabet remains a strong company with a bright future and its share price will recover in due course.

We will keep a close watch on how Alphabet (Google) share price is interacting with the above low and the high (92.15) printed just after Covid in the year 2020 to look for a buying opportunity in future. We will post then following this post of which shares to buy and when.

Conclusion:

In conclusion, there are a number of factors influencing the stock market at present but we believe that there are still some good opportunities to buy shares and when. We will post in following weeks/ months which shares to buy.

We are always there to support you, when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram and Discord.

N P Financials Pty Ltd

Level 3, 2 Brandon Park Drive

Wheelers Hill, Victoria 3150

Phone: +61 3 9790 6476

email: [email protected]

Let’s chat https://discord.gg/5HkVUCk6KB

===================================================================================================================================

Our blog post dated 31.07.2022:

Amazon Share Price reached our Profit Target.

On 18.07.2022, we analysed the share price of Amazon when it was trading at 113.77.

In our analysis for the share price of Amazon in our paid Client Arena, we wrote, “An interesting inverse Head and Shoulder (Head-Stand) can be noticed in action in Amazon Inc Share’s Daily Price Pattern. The head swing low was plotted on 14.06.2022 with left shoulder plotted on 24.05.2022 and the right shoulder plotted on 30.06.2022.

The neckline angel can be approximately 29 degree downwards. Book Profit Target (BPT) from this inverse Head and Shoulder (Head Stand) for AMZN/USD can be at 136.36 if the price is crossing to the upside of 118.18 level”.

From 18-07-2022 to 29-07-2022, within only 10 days, Amazon share price reached our Book Profit Target (BPT) of 136.36 with a humongous profit of 2,259 points.

With $1 per point (mini lot) this means a generation of $2,259 and with $10 per point (standard lot) this means a generation of $22,590.

We have been achieving these types of successes for the last 7 years through our blog posts. You can also do the same.

We are always there to support you, when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram and Discord.

N P Financials Pty Ltd

Level 3, 2 Brandon Park Drive

Wheelers Hill, Victoria 3150

Phone: +61 3 9790 6476

email: [email protected]

Let’s chat https://discord.gg/5HkVUCk6KB

=================================================================================================================================

Our related Blog Post dated 10.10.2021:

Things to do when choosing a Share Trading Course.

Are you interested in a Share Trading Course? There is a lot to learn before you get started with a Share Trading Course. Taking a Share Trading course is the best way to set yourself up for success in Share Trading.

There is a wide variety of courses available today. The following are some tips to help you find the best course for you.

- Check the content of the Share Trading course:

If you want to learn how to do Share Trading, it is important to learn as much as you can. Search for courses that will take you through the fundamentals of Share Trading through to the more technical aspects of the stock market. The course should provide you with the knowledge and skills you need to develop an effective strategy for success in Share Trading.

- Check the instructors

There is no better way to learn Share Trading than from professional traders that started out like you and are now successful. You can learn from their failures and successes. You will also get an insider’s view of the market from them.

Search for courses that are taught by professional traders. A program that offers mentorship is ideal as you will have the opportunity to apply what you have learnt under the guidance of a professional trader.

- Read reviews

The best way to identify a Share Trading course at Melbourne is by reading reviews on available courses. Reading reviews by students that have taken the course is the best way to learn about what to expect from the course.

Search for reviews on independent platforms. Social media is a great place to start. Read blogs and reviews on consumer sites too.

Use the tips above when searching for a Share Trading course. These will help you identify a reliable course that will set you on the path to success in Share Trading.

You can also start trading like us and develop yourself to become a predictive technical analysis expert trader in any of the asset classes, you want to consider for buying or selling, when you are trained by us.

To take advantage of our share trading portfolio, click here.

Our Unique, Proprietary and most accurate Share Trading Course will guide you to identify these trade-able markets before they start to explode.

When you are trained by us and learn how to trade Stock Markets by taking advantage of our Knowledge and Expertise in the field, you can be benefited on a regular basis in Stock Markets like Tesla Motors (TSLA), AAPL (Apple Inc), AMZN (Amazon.com Inc), COH (Cochlear Ltd) and CSL (CSL Ltd) etc. Taking a Share Trading course is the best way to set yourself up for success in Share Trading.

To Trade Stock Markets in the Professional way and to find out the answers to all your Shares Trading related queries, please contact us at 03 9015 4858 and book your FREE discussion session for 30 minutes at Level 3, 2 Brandon Park Drive, Wheelers Hill, Victoria 3150.

Our Blog Post dated 6th December 2020:

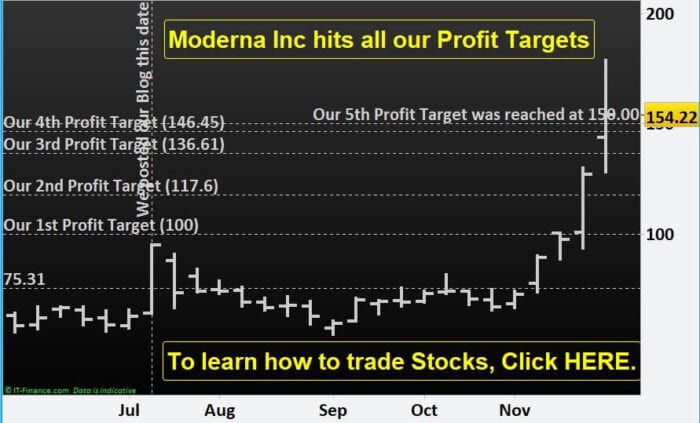

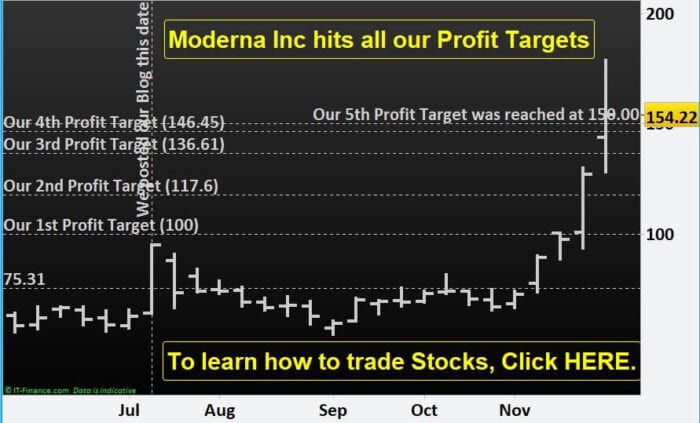

Covid 19 Vaccine and the Market: Moderna Inc (ticker: MRNA) hits all our Profit Targets set on 19th of July 2020.

Much before the Covid 19 vaccine was discovered, we wrote in our blog post dated 19th of July 2020 for Moderna, “MRNA can do a break-out from the current level of US$ 94.87 by breaking the highest point so far it has reached which is equal to US$ 95.00. Then the price objectives can be as follows:

US$ 100.00

US$ 117.60

US$ 136.61

US$ 146.45

US$ 150.00”.

Out of more than 140 teams of researchers racing to develop a safe and effective Covid 19 vaccine, we selected the American biotech company Moderna (ticker: MRNA) way back in July 2020. We selected the American biotech company Moderna (ticker: MRNA) much before the vaccine for Covid 19. Taking a Share Trading course is the best way to set yourself up for success in Share Trading.

And exactly as per proprietary trading strategy analysis for Share Trading dated July, 19 2020 Moderna did actually achieve all our 5 set profit targets as below:

Moderna reached our first profit target set at 100.00 on week number 47 (from 16-Nov-2020 to 20-Nov-2020)

Moderna hit our second profit target set at 117.60 on week number 48 (from 23-Nov-2020 to 27-Nov-2020)

Moderna reached our third profit target set at 136.61 on week number 49 (from 30-Nov-2020 to 04-Dec-2020)

Moderna hit our fourth profit target set at 146.45 on week number 49 (from 30-Nov-2020 to 04-Dec-2020)

And now Moderna reached our fifth profit target of 150.00 on week number 49 (from 30-Nov-2020 to 04-Dec-2020).

You must be wondering how are we magically achieving each of the time each of our set profit targets. You can also start trading like a us and develop yourself to do a predictive technical analysis expert trader in any of the asset classes, you want to consider for buying or selling, when you are trained by us.

To take advantage of our share trading portfolio, click here.

Our Unique, Proprietary and most accurate Share Trading Course will guide you to identify these markets before they start to explode. Taking a Share Trading course is the best way to set yourself up for success in Share Trading.

When you are trained by us and learn how to trade Stock Markets by taking advantage of our Knowledge and Expertise in the field, you can be benefited on a regular basis in Stock Markets like Tesla Motors (TSLA), AAPL (Apple Inc), AMZN (Amazon.com Inc), COH (Cochlear Ltd) and CSL (CSL Ltd) etc.

To Trade Stock Markets in the Professional way and to find out the answers to all your Shares Trading related queries, please contact us at 03 9015 4858 and book your FREE discussion session for 30 minutes at Level 3, 2 Brandon Park Drive, Wheelers Hill, Victoria 3150.

Our Blog Post dated July, 19 2020:

Covid 19 Vaccine and the Market: In this post let us throw some lights on one company’s stock price which is quite ahead in the race for developing the Covid 19 Vaccine. Below mentioned is according to the latest article on Covid 19 Vaccine published at https://www.theguardian.com/world/ng-interactive/2020/jul/18/coronavirus-vaccine-tracker-how-close-are-we-to-a-vaccine

According to the same source on Coronavirus as above, “American biotech company Moderna is developing a vaccine candidate using messenger RNA (or mRNA for short) to trick the body into producing viral proteins itself. No mRNA vaccine has ever been approved for an infectious disease, and Moderna has never brought a product to market. But proponents of the vaccine say it could be easier to mass produce than traditional vaccines”.

This topic on Coronavirus Vaccine has given us an opportunity to analyse the stock price movement of the company named, Moderna (Ticker: MRNA).

MRNA is now trading at an all time high price level of US$ 94.87. In this month of April the stock price of MRNA has appreciated 69.41% (from a low of US$ 56.00 to the current high level of US$ 95.00). In this year alone the stock price of MRNA has appreciated 436.60% (from a low of US$ 17.68 to the current high level of US$ 95.00).

If this market (MRNA), is retracing a bit to generate new long opportunities, we are looking at the following levels:

US$ 87.00 or

US$ 80.53 or

US$ 75.31.

Otherwise MRNA can do a break-out from the current level of US$ 94.87 by breaking the highest point so far it has reached which is equal to US$ 95.00. Then the price objectives can be as follows:

US$ 100.00

US$ 117.60

US$ 136.61

US$ 146.45

US$ 150.00

We need to remember, that market is always right and it can and will do whatever it does. Having said all these if the trial for Coronavirus Vaccine for MRNA is not as per market’s perception then it can move the other way as well. Taking a Share Trading course is the best way to set yourself up for success in Share Trading.

To take advantage of our share trading portfolio, click here.

Our Unique, Proprietary and most accurate Share Trading Course will guide you to identify these markets before they start to explode.

When you are trained by us and learn how to trade Stock Markets by taking advantage of our Knowledge and Expertise in the field, you can be benefited on a regular basis in Stock Markets like Tesla Motors (TSLA), AAPL (Apple Inc), AMZN (Amazon.com Inc), COH (Cochlear Ltd) and CSL (CSL Ltd) etc.

To Trade Stock Markets in the Professional way and to find out the answers to all your Shares Trading related queries, please contact us at 03 9015 4858 and book your FREE discussion session for 30 minutes at Level 3, 2 Brandon Park Drive, Wheelers Hill, Victoria 3150.

Useful Links:

Learn Share Trading with Partha Banerjee of N P Financials, the Prop Trading Firm at Melbourne

Learn how to Trade the Directional Share Market. Get mentored in the art and science of Share Trading in our proprietary 6 months developmental course. Derive benefit from our effective Share Trading Strategies.

Learn Basics of Forex Trading with Partha Banerjee of N P Financials, the Prop Trading Firm at Melbourne

On completion of the “Basics of Trading” course, You will develop an In-depth understanding of Fundamentals factors moving Markets. You will be able to clearly understand the Market Jargon e.g. Swaps, Spread, Slippage etc.

Start Share Trading with Market leaders at Melbourne, Australia.

N P Financials is a Traders Training Facility where we train newcomers as well as professionals on how to trade Forex, Shares, Commodities, Bond & Indices. Our preferred broker is GO Markets.