N P Financials, the leading prop trading firm based in Australia, has been recognized and awarded as the Best Regulated Prop Trading Firm for the year 2023. This prestigious award is a testament to our commitment to providing exceptional service to clients, while adhering to the highest standards of regulatory compliance.

The award is particularly noteworthy given the stringent regulations governing prop trading firms in Australia. We have consistently demonstrated a strong compliance culture, implementing rigorous risk management procedures and ensuring that our traders operate within the boundaries of the law.

In addition to regulatory compliance, we are also known for innovative trading strategies and cutting-edge technology. Our experienced traders use advanced algorithms and data analytics to identify profitable trading opportunities in the markets, while minimizing risk.

Our success is a reflection of our client-centric approach, which emphasizes transparency, integrity, and collaboration. We work closely with our clients to understand their unique needs and objectives, and tailors our trading strategies accordingly.

Overall, N P Financials’ recognition as the Best Regulated Prop Trading Firm for 2023 is a testament to our excellence in all aspects of the business, from regulatory compliance to technological innovation to client service.

Best Prop Firm:

=====================================================================================================================================

Our Blog Post dated 27.09.2022:

In this blog post video, we have demonstrated the various ways N P Financials as one of the leading prop firms helping thousands of aspiring as well as professional traders to excel in their trading journey.

In a world of Forex trading prop firms where most people are chasing money and recognition, we focus on quality instead of quantity. Our one-on-one Forex Trading mentoring sessions come from the best of professional traders who have proven success in this industry- all sourced within Australia. There’s no better prop firms team for you to learn with than N P Financials.

We have been in this Trading business too long to know that there is no holy grail, all we do at N P Financials, as one of the leading prop firms, is look for trade opportunities that present higher probability than average. Successful Forex traders at N P Financials utilise practical, proven Forex trading strategies.

To us, entering the markets with a well-developed plan is the key to earning profits and building sustainable income in this exciting business of investing on international currencies. Our successful prop firms Forex traders are trained to know that success comes from following sound investment principles rather than guessing what will work best and we, as one of the leading prop firms, do so by employing an effective strategy tailored specifically for their needs.

In this very popular video, we have discussed in full length many things but the following extremely pertinent aspects of successful prop firms’ way of trading are really in-depth with lots of questions of the participants :

- N P Financials’ Discord Live Trading rooms‘ tour.

- Power of Channels– how to trade them under prop firms.

- How to take advantage of the leading Divergence indicator in prop firms?

- Which Audition/ Evaluation is suitable for your Trading Style and Why?

- Actual Lot size to be traded for different account sizes in prop firms.

- Concept of Liquidity Bars and how to Trade them in prop firms.

- Where to put stop-loss for Trading Liquidity Bar in prop firms.

- What happens behind the scene during Market open.

- How to identify and Trade “No Demand” days in prop firms?

- How to identify “Buying Complex“?

- How to avoid falling in a trap of a poor Trading position?

- How to develop an excellent Trade Journal in prop firms?

- How to read Currency Correlation in prop firms?

N P Financials offers a unique opportunity to learn how to trade under professional prop firms. This illustrative video provides an in-depth look at the power of channels and how they can be used to your advantage.

N P Financials’ leading divergence indicator is a powerful tool that can be used by prop firms to take advantage of certain market conditions. By understanding how this indicator works, prop firms can use it to their advantage and make informed decisions about when to enter and exit the market. N P Financials’ leading divergence indicator is based on the concept of leading indicators, which are indicators that can be used to predict future price movements much in advance.

Our team will help you find the right audition/evaluation process that is tailored to your trading style. Finally, we break down the concept of liquidity bars and show you how they can be traded for maximum profits under professional prop firms.

If you are interested in learning more about our Discord Live Trading rooms, please click here.

We are always there to support you, when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram and Discord.

Level 3, 2 Brandon Park Drive

Wheelers Hill, Victoria 3150

Phone: +61 3 9790 6476

email: [email protected]

Let’s chat https://discord.gg/5HkVUCk6KB

====================================================================================================================================

Our Post dated 07.09.2022:

Celebrating 50,000 points from prop firms Trade Signals consistently for the last 68 months.

We are excited to announce that our trade signals have generated 50,000+ points consistently for the last 68 months in Forex, Shares, Commodities, Indices and Cryptocurrencies. A total of 585 trade signals were put in this last 68 months to generate these 50,000+ points. These 50,000+ points were captured at an average of 743 points per month with an average of 86 points per trade.

As Smart Traders at N P Financials, we pride ourselves in being able to generate consistent and reliable trade signals that have generated 50,000+ points over the last 68 months. In this blog post, we will show you how we have been able to achieve this consistency and what you can do to replicate our success.

In these 68 months, our trade signals have been accurate 83.82% of the time. Out of the 585 trade signals in the last 68 months, 513 of them were profitable while 72 were unprofitable. The biggest monthly return was 9,837 points in September 2018 and the biggest drawdown was -364 points in June 2022.

How our trade signals are created:

The first step to generating consistent trade signals is understanding the market. Our team of experienced traders spend countless hours analyzing the market so that we can identify any potential opportunities. Once we have identified an opportunity, we will then generate a trade signal for our members.

We have been in this Trading business too long to know that there is no holy grail, all we do at N P Financials is look for trade opportunities that present higher probability than average in all the 5 asset classes (Forex, Shares, Commodities, Indices and Cryptocurrencies). Our Trader Development Programs which you are (or will be) going through are extremely powerful and you will continue to benefit from our proprietary Trading Strategies, sample Trade Ideas which have generated 50,551 points in the last 68 months at an average of 743 points per month and 86 average points per Trade.

Our team of expert traders create these trade signals on a regular basis by analyzing the market conditions and price movements of various assets through our proprietary risk managed trading system. We take into consideration different factors such as support and resistance levels, ROF, trendlines, prop patterns, demand & supply levels, BONBT and much more. With years of experience in trading the financial markets, our team is able to generate trade signals that have helped our clients profit from the market movements.

Our trade signals are not based on guesswork or hunches. Instead, they are based on data-driven and technical analysis so that our traders can feel confident when they make a trade. In fact, our trade signals have an average success rate of 83.82%.

The next step is following our trade signals. We recommend that our members follow our email alerts so that they never miss a trade signal.

Once you have followed our trade signals and made a profit, it is important to take some time to learn from your successes and failures. This will help you become a better trader and increase your chances of success in the future.

The Benefits of using our trade signals:

By using our trade signals, you will be able to make informed decisions when trading various assets. You can either choose to trade manually or set up your own automated trading system to trade according to our signals. Our clients have found that by using our trade signals, they are able to save time and energy as they no longer need to do their own analysis of the markets.

In addition, by using our trade signals, you can be assured that you are getting reliable and accurate information that can help you generate points in the financial markets. Our expert trading team carefully analyzes the different markets before issuing a signal so that you can be confident that you are making a wise decision when entering or exit a trade.

Conclusion:

If you are looking for a reliable way to generate points in the financial tradeable markets, look no further than our trade signals! With an accuracy rate of 83.82%, you can be assured that you will be generating points if you follow our trade signals. Trading has never been easier with our team doing all the analysis for you! All you need to do is follow our trade signals!

By following the steps outlined in this blog post, you can increase your chances of success as a trader and generate consistent points over time. If you would like to learn more about how to trade or if you need help setting up email alerts, please feel free to contact us at +61 3 9790 6476 or [email protected]. Thank you for reading!

We have been achieving these types of successes for the last 7 years through our Proprietary Trading Strategies as demonstrated in our blog posts. You can also derive such profitable benefits when you are trained by us.

We are always there to support you, when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram and Discord.

Level 3, 2 Brandon Park Drive

Wheelers Hill, Victoria 3150

Phone: +61 3 9790 6476

email: [email protected]

Let’s chat https://discord.gg/5HkVUCk6KB

=================================================================================================================================

Our Blog post dated 20th of August’ 2022:

10 Trades in our Free Discord Channels resulted in 13,097 points in the last 1 month.

Markets are moving fast, so are we. In the last 1 month, 10 Trades have resulted in a massive 13,097 points. Let us take this opportunity to discuss these recent 10 Trades. These 10 Trades are from different asset classes viz. Shares, Indices, Commodities and Cryptocurrencies.

Let’s break these 10 trades asset class-wise:

Shares:

Square (Now Block Inc) Inc trades

Amazon Inc trades

Apple Inc trades

CSL Ltd trades

Commodities:

Spot Gold trades

Natural Gas trades

Indices:

DAX40 (or GER30) trades

Hangseng 50 (HK50) trades

SPX500 trades

Cryptocurrency:

ETHUSD (Ethereum) trades

Out of these 10 Trades, first one is Square (now Block Inc) Inc.

In our analysis for Square Inc share trades on 20.07.2022 on our Discord (https://discord.gg/5HkVUCk6KB) Share Trading Room, we wrote, “

Exactly as per above analysis, Square (now Block Inc) Inc reached our set Profit Target with a gain of 1,945 points for 100 shares which is equivalent to $1,945 when invested $1 per point and $19,450 when invested $10 per point (standard lot).

Out of these 10 Trades, 2nd one is Amazon Inc.

In our analysis for Amazon Inc share trades on 20.07.2022 on our Discord (https://discord.gg/5HkVUCk6KB) Share Trading Room, we wrote, “

Exactly as per above analysis, Amazon Inc reached our set Profit Target with a gain of 1,812 points for 100 shares which is equivalent to $1,812 when invested $1 per point and $18,120 when invested $10 per point (standard lot).

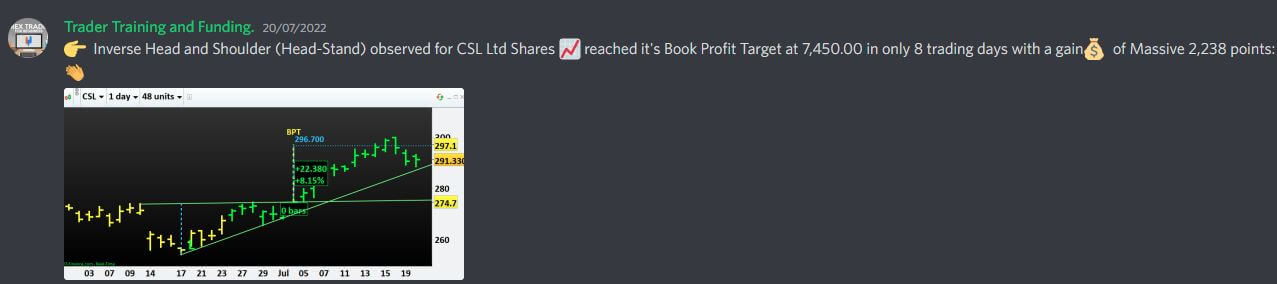

Out of these 10 Trades, one other share is CSL Ltd

Our analysis for CSL Ltd share trades on 20.07.2022 on our Discord (https://discord.gg/5HkVUCk6KB) Share Trading Room: Inverse Head and Shoulder (Head-Stand) observed for CSL Ltd Shares reached it’s Book Profit Target at 296.70 in only 8 trading days with a massive gain of 2,238 points which is equivalent to $2,238 when invested $1 per point and $22,380 when invested $10 per point (standard lot).

Out of these 10 Trades, one Cryptocurrency is ETHUSD

Our analysis for ETHUSD Cryptocurrency trades on 19.07.2022 on our Discord (https://discord.gg/5HkVUCk6KB) Cryptocurrency Trading Room: Inverse Head and Shoulder (Head-Stand) observed for ETHUSD reached it’s Book Profit Target at 1,770 with a gain of massive 302 points which is equivalent to $302 when invested $1 per point and $3,020 when invested $10 per point (standard lot).

Out of these 10 Trades, one Index is SPX500

Our analysis for SPX500 Index trades on 20.07.2022 on our Discord (https://discord.gg/5HkVUCk6KB) Index Trading Room, we wrote, “

Exactly as per above analysis, SPX500 reached our set Profit Target with a gain of 341 points which is equivalent to $341 when invested $1 per point and $3,410 when invested $10 per point (standard lot).

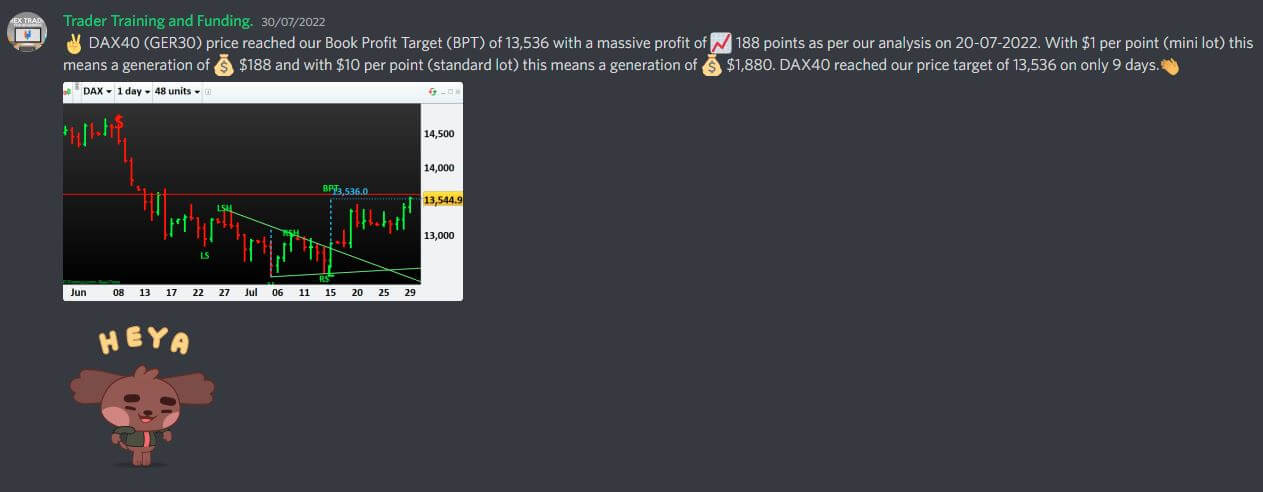

Out of these 10 Trades, one other Index is DAX40 (GER30)

Our analysis for DAX40 (GER30) Index trades on 20.07.2022 on our Discord (https://discord.gg/5HkVUCk6KB) Index Trading Room, we wrote, “

Exactly as per above analysis, DAX40 reached our set Profit Target with a gain of 207 points which is equivalent to $207 when invested $1 per point and $2,070 when invested $10 per point (standard lot).

Out of these 10 Trades, one Commodity is Natural Gas (NG)

Our analysis for Natural Gas (NG) Commodity trades on 20.07.2022 on our Discord (https://discord.gg/5HkVUCk6KB) Commodity Trading Room: Inverse Head and Shoulder (Head-Stand) observed for NG (Natural Gas) Commodity reached it’s Book Profit Target at 7,450.00 in only 7 trading days with a massive gain of 1,190 points which is equivalent to $1,190 when invested $1 per point and $11,190 when invested $10 per point (standard lot).

The rest 4 instrument trades (AAPL shares, Spot Gold, Hangseng 50 (HK50)) did reach all their set profit targets resulting in a humongous total gain of 13,097 points in the last 1 month.

We have been achieving these types of successes for the last 7 years through our Proprietary Trading Strategies as demonstrated in our blog posts. You can also derive such profitable benefits when you are trained by us.

We are always there to support you, when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram and Discord.

Level 3, 2 Brandon Park Drive

Wheelers Hill, Victoria 3150

Phone: +61 3 9790 6476

email: [email protected]

Let’s chat https://discord.gg/5HkVUCk6KB

=================================================================================================================================

Our Blog Post dated 31.07.2022:

Amazon Share Price reached our Profit Target.

On 18.07.2022, we analysed the share price of Amazon when it was trading at 113.77.

In our analysis for the share price of Amazon in our paid Client Arena, we wrote, “An interesting inverse Head and Shoulder (Head-Stand) can be noticed in action in Amazon Inc Share’s Daily Price Pattern. The head swing low was plotted on 14.06.2022 with left shoulder plotted on 24.05.2022 and the right shoulder plotted on 30.06.2022.

The neckline angel can be approximately 29 degree downwards. Book Profit Target (BPT) from this inverse Head and Shoulder (Head Stand) for AMZN/USD can be at 136.36 if the price is crossing to the upside of 118.18 level”.

From 18-07-2022 to 29-07-2022, within only 10 days, Amazon share price reached our Book Profit Target (BPT) of 136.36 with a humongous profit of 2,259 points.

With $1 per point (mini lot) this means a generation of $2,259 and with $10 per point (standard lot) this means a generation of $22,590.

We have been achieving these types of successes for the last 7 years through our blog posts. You can also do the same.

We are always there to support you, when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram and Discord.

Level 3, 2 Brandon Park Drive

Wheelers Hill, Victoria 3150

Phone: +61 3 9790 6476

email: [email protected]

Let’s chat https://discord.gg/5HkVUCk6KB

=================================================================================================================================