N P Financials is a proprietary trading firm that develops and funds traders— enabling them to earn more profits on their trading skills.

NPF Capital Audition is a set of auditions we are conducting to find good traders who can follow the risk & money management rules and achieve laid down targets using their trading style.

To become a Funded Trader, you must first pass an audition to demonstrate your trading skills and discipline as competent traders. Upon successful completion, you will receive a funded account of up to $1 million.

You keep 70% of the profit generated in your funded account.

Anyone whose age is 18 or more can become a Funded Trader. If you can successfully pass the NPF Trader Audition— demonstrating profitability and responsible risk and money management skills— then you can be funded by us.

For you to become a Funded Trader, there are only 2 steps as below:

- Choose the assessment tier that fits you best and take the NPF Capital Audition

- Pass the audition, we’ll set you up with a funded account.

It’s that easy.

Unlike most of the other firms, we don’t have a minimum number of days, trading days or unique trades for you to pass and become a Funded Trader with N P Financials. To pass the Audition, generate a return of 10% in your account while not incurring a daily drawdown of 4% or a maximum trailing drawdown of 5%.

After you pass the Audition, you’ll receive an email with your account credentials. The funded account will be ready for you to trade, subject to the same risk management rules.

You need to remember that there are two different types of breach: a hard breach and soft breach as below:

- Violation of the daily or maximum drawdown constitutes a hard breach. You must place a trade at least once every 30 days, else you will fail the audition. This is a hard breach.

- Soft breach occurs:

- if you do not close positions by market close on Friday, or

- if you place a trade without a stop-loss.

If a soft breach occurs, the trade is closed automatically by the system and you can continue to trade. If a hard breach occurs, your account access will be revoked. Any profits earned by you at that time will be distributed. In either case, you can always start again with another Audition. A discount may be available for a repeat audition.

Traders will trade the same account balance as their Audition. If you have traded with $500,000 for the audition, you would also manage $500,000 worth of our capital in your funded trader account.

All Audition accounts are demo accounts with virtual funding. Upon successful completion of the Audition, you will receive login credentials to a live trading account with real funds. Traders are then entitled to 70% of profits generated in the live account.

In order to trade an account with a higher account balance, you can apply for the respective Audition. However, a trader can only have one account per Audition tier. Each account is independent and starts with an Audition.

If you are trading a $100,000 account and wish to trade more, you can apply for a $50,000 account by taking a $50,000 Audition for example. However, to diversify our risk and exposure, those accounts must not be traded with the same strategy, per our Terms & Conditions.

Not at this time. Each account is independent of one another.

Trading account dashboard includes metrics on: daily loss limit, profit target, maximum loss limit, equity, balance, monthly return and projected annual return. In addition, you’ll have access to a comprehensive account history with all executed trades.

No, there are no hidden fees. The fee for the NPF-Trader Audition is all you’ll ever incur. There are no recurring monthly fees.

You may apply for the NPF-Trader Audition by choosing your tier here. Upon form submission, you will be directed to the payment page and receive an order confirmation email.

The Audition fee is non-refundable. In fact, it is the only investment you’ll ever make into our program. No hidden fees. No monthly subscriptions. If you fail in our Audition, you need to purchase a new Audition with its associated fee.

There are a few reasons. First and foremost, the fee covers various operating expenses for NPF-Trader— including technology platforms, personnel, customer service functions, marketing and all the healthy expenditures that make a company strong.

In addition, the fee ensures that the trader is committed to the process and committed to successful, disciplined trading practices. When a trader has skin in the game, so to speak, they are incentivized to treat their account responsibly and with the utmost care.

After all, the fee is but a small token of commitment rewarded with hundreds of thousands of dollars in real capital to trade. The best part of this arrangement for traders is that it is the only capital they risk. Traders cannot lose more than this fee, as losses on a live funded account are covered by NPF.

The NPF-Trader Audition fee serves as a filter for serious traders. The NPF-Trader community only works when it is comprised of experienced traders that can consistently generate a profit. With limited resources, the NPF-Trader Audition process reveals those who are committed and responsible traders.

At the end of the day, the NPF-Trader program is an extremely valuable service— a win-win for everyone— and the service is accurately priced to support a symbiotic relationship.

For both the demo NPF Capital Audition account and live trading accounts, the following rules apply:

- Max 4% daily loss limit. This is a hard breach.

- 5% max trailing drawdown. This is a hard breach.

- You must place a trade at least once every 30 days, else you will fail the audition. This is a hard breach.

- Stop-loss required for each trade

- Flat for the weekend — all positions closed on Friday at 4PM EST

Note that the daily loss limit applies to current daily equity. For example, a trader with a $100,000 funded account would have a $4,000 daily loss limit. If the trader ran up a profit of $10,000, their new daily loss limit would be $4,400 which is 4% of their new Balance of $110,000.

In addition, there is a limit on the maximum number of open lots. If you are in the $100,000 plan, you will have 10 open lots with risk available. If you buy 5 lots of EUR/USD at 1.2000 and your stop loss is at 1.1800, you would have 5 lots on with risk, so you would have 5 still available. If the EUR/USD moves up to 1.2500, and you update your stop loss to be at 1.2000, which would be your open price, you no longer have risk on that trade.

So, you would again have 10 lots available, even though you currently have 5 lots open. In the event that you put on too many trades with risk, then our system will liquidate all trades that currently have risk.

This is only considered a soft breach though, which means, even though you violated the rule, you can continue on trading, and should you reach your 10% profit target (without violating daily or maximum loss limits), you would be upgraded to a live funded account.

We calculate the daily loss limit based on the previous day’s end of day balance. For example, if your prior day’s end of day balance was $100,000, your account would breach when your equity reached $96,000 that day.

Additionally, because we base the daily stop out level on a %, and not a fixed $ amount, the more money you make in your account the wider your daily stop loss is. For example, if you start with a $100,000 balance and grow that account to a $110,000 balance, your daily stop out level is now $4,400 vs. $4,000 previously.

Our Maximum Trailing Drawdown is the maximum your account can drawdown before breaching your account. The initial level is set at 5% from the starting balance of your account. As your account balance increases, the trailing maximum drawdown follows you up until you achieve a profit target of 5% in your account.

Once you have achieved a 5% profit target in your account, we take off the trailing drawdown and allow our traders to draw back down to their initial starting balance before breaching the account.

The Max Trailing Drawdown is 5% of your starting balance . For example, if your account size is $100,000 then it will be $5,000. So, if you make profit and your HWM (High Water Mark) on Closed Trades is going up to $102,500 then your breach level will be = (HWM Closed Trades - $5,000)= $102,500 - $5,000= $96,500. Another example, if you have a $100,000 account, you can go down to $95,000 before being disqualified. Let’s say you are a profitable trader and make $4,000 in your account. Your High-Water Mark is now $104,000 (balance, so just closed trades). Your max drawdown limit will be $99,000. Next, you make an additional $1,000 in your account.

So, your new High-Water Mark is $105,000. Here is where it will lock in, so as your High-Water Mark rises (let’s say to $106,000, $107,000, etc.) your max drawdown limit will stay at $100,000.

Traders may have a maximum number of open lots equal to 1/10000 the size of their account.

Below are the maximum open lots across all pairs that a trader can have at any given time.

- $25,000 account – 2.5 lots with risk

- $50,000 account – 5 lots with risk

- $100,000 account – 10 lots with risk

- $250,000 account – 25 lots with risk

- $500,000 account – 50 lots with risk

- $1 million – 100 lots with risk

For example, if you are in the $100,000 plan you will have 10 open lots with risk available.

If you buy 5 lots of EURUSD at 1.2000 and your stop loss is at 1.1800, you would have 5 lots on with risk, so you would have 5 still available. If the EURUSD moves up to 1.2500, and you update your stop loss to be at 1.2000, which would be your open price, you no longer have risk on that trade.

So, you would again have 10 lots available, even though you currently have 5 lots open. In the event that you put on too many trades with risk, then our system will liquidate all trades that currently have risk.

This is only considered a soft breach though, which means, even though you violated the rule, you can continue on trading, and should you reach your 10% profit target (without violating daily or maximum loss limits), you would be upgraded to a live funded account.

Yes, you can trade news.

In a live trading account with real funds, NPF Capital Audition requires that traders be flat over the weekend. In other words, all traders must close their positions before the markets close for the weekend. If you don’t close your positions, we will liquidate them for you before the close of the market.

You can hold trades overnight.

We do not limit your trading style or strategy, in any way. Whether your strategy involves discretionary trading, hedging, algorithmic trading, Expert Advisors (EAs) or anything else, you can use it with NPF Capital Audition.

Traders can execute trades on a variety of CFD market instruments — including Forex, cryptocurrency, metals and energy, and stock indices.

Forex, Metals, Oils and Indices receive up to 10:1 leverage. Cryptocurrencies receive 2:1 leverage.

You are responsible for all applicable tax obligations in your country or region.

Traders will have the same live account balance as they chose for the Audition. Once a trader passes the audition and results are verified, they will be provided credentials to a live account — where they are entitled to 70% of profits generated.

There are no live account upgrade options for account size. Traders should choose the appropriate account size when applying for the Audition.

NPF-Traders can request a withdrawal of profits at any time, but no more frequently than every thirty (30) days.

When a withdrawal is requested, NPF will also withdraw its share of the profits and your new highwater equity will be marked down by the total amount of funds withdrawn.

For example, let’s say a trader with a funded $100,000 account posts a profit of $20,000. When they take their 70% profit or $14,000, NPF-Trader would also redeem 30% of profits in the amount of $6,000. Thus, the new account balance, after withdrawal, would be $100,000 and all daily loss limits and trailing drawdown rules would apply to this balance.

In addition, upon withdrawal, the high-water mark for the maximum trailing drawdown is reset to the starting balance. The rationale behind this is that our program is designed to be mutually beneficial. By not locking in the maximum drawdown at the initial balance, it puts our firm at risk of losing money, while having paid out profits to a trader.

Example: You have taken an account from $100,000 to $110,000. You then request a withdrawal of $10,000. In this scenario we would pay you $7,000 and we would retain $3,000. This would also take the balance of the account back down to $100,000, effectively resetting the account back to the start.

Your account would then be able to have the 5% maximum drawdown again, meaning you could lose $5,000. In this scenario you would have been paid $7,000 in profits, while our firm lost $3,000. So, the rule of locking in the maximum trailing drawdown at the starting balance upon the initial withdrawal ensures a mutually beneficial, long-lasting partnership.

Traders may have multiple funded accounts, but only one per Audition tier. So, for example, if you are trading a $100,000 account and wish to trade more, you can apply for a $50,000 account by taking a $50,000 NPF-Trader Audition.

- Please click on https://npfinancials.com.au/npf-capital-audition/

- Select the Audition (from Start-up, Transition, Competent etc) of your choice.

- Click "Start Trading" below the Audition:

- Select from MT4 or MT5:

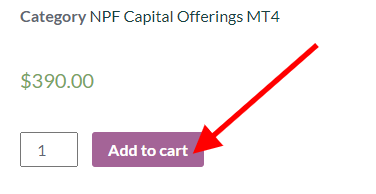

- Click "Add to cart" at the bottom right-hand corner:

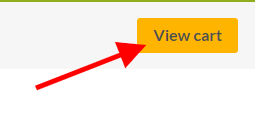

- Click "View cart" at the top right-hand corner:

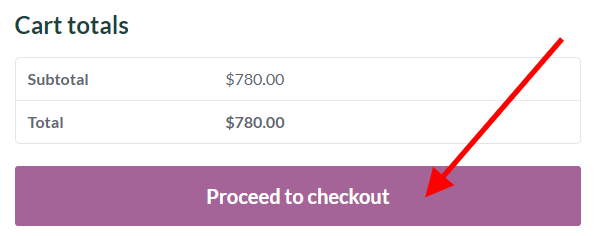

- Click "Proceed to checkout":

- Fill in the Billing Details (First name, Last name, Country, Street address, Suburb, State, Postcode, Phone, Email):

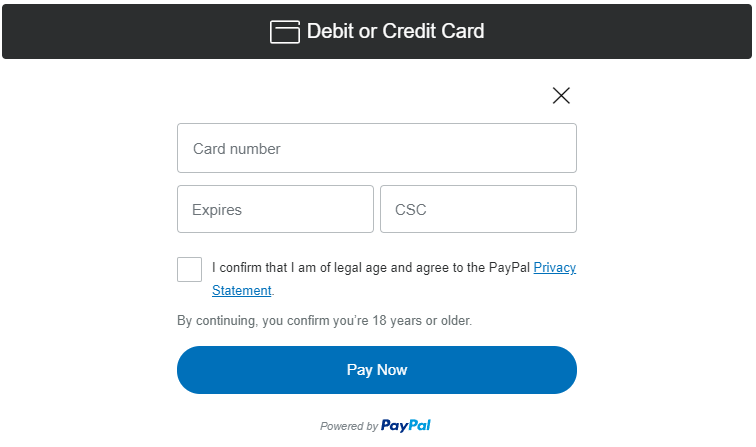

- Click on "Debit or Credit Card" & fill in the Card Details & then Click "Pay Now":

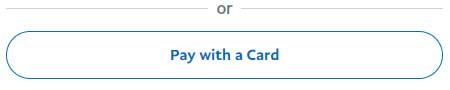

- Click on "Pay with a Card":

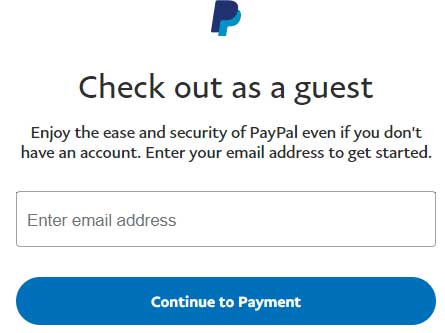

- Check out as a guest:

(Enjoy the ease and security of PayPal even if you don't have an account. Enter your email address to get started.)

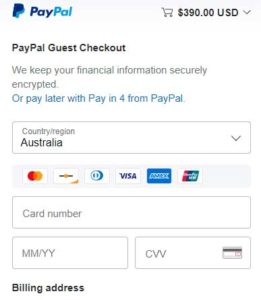

- Please fill in the Card and Billing details:

- Select the Button, "No, I don't want an account now" and Tick Mark the check box stating with, "You are at least 18 years old….." and then Click on Continue:

Read More about NPF Capital FAQ

NPF Capital FAQ, NPF FAQ, Capital FAQ, FAQ for NPF, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ, FAQ

Thank

you for your interest in Australia’s #1

Prop Trading Firm- N P Financials, Training and Funding Traders since 2016.

As a special goodwill gesture, we are willing to give you a BIG 10% Discount on all of our Auditions. To avail this BIG 10% Discount please put “Coupon Code as “NPF-P10” to avail 10% Discount” on all of our Auditions.

We have the Simplest (Single Step with No Maximum days to Pass the Audition) Funding Model in the Industry with great results and are always looking for good traders to trade our company’s capital.

Take the first step toward becoming a NPF Funded Trader, getting access to our capital, and keeping 70% of the profit from your trades. Now it’s time to get serious.

To become an approved trader for us, you need to pass our evaluation program, the NPF Proprietary Trading Audition.

This is a simple test that helps us assess your trading skills, risk management, and money management skills.

>>Click on https://npfinancials.com.au/npf-capital-audition to get started with your evaluation now (takes just 5 minutes).

Why join N P Financials?

We know that many talented traders, like you, struggle to raise capital.

That’s why we offer funds from US $25,000 to US $1,925,000 and a ton of benefits:

· There’s no monthly subscription.

· No hidden cost.

· There’s a single one-time fee

· Get your account up and running within minutes.

· No rush – there are no minimum or maximum trading days to pass the evaluation.

We offer you 5 asset classes to trade via our broker:

· Forex– with raw spreads

· Equities– 646 Shares

· Cryptos– 377 cryptocurrencies

· Metals & Oil– XAU, XAG, XPT, Oil

· Indices– 17 Stock Index Markets

Just pass the test, get funded quickly, and enjoy the freedom to trade your way:

· Trade your own strategy or one of our strategies.

· EA is allowed.

· Hedging is allowed.

· Copy Trading is allowed.

Here is an example:

You select Progressive US$ 250,000

You pass the audition and make 3% a month which is equal to US$ 7,500

Your Profit Share pay-out= 70% * US$ 7,500 = US$ 5,250

At https://npfinancials.com.au/product/client-arena/ our clients are getting 48,456 points in the last 65 months at an average of 745 points per month and 89 average points per Trade.

Want to match or exceed those results?

Start making serious money today!

Here’s a step-by-step guide to start your Audition today (e.g. US$25,000 “Start-Up” Evaluation or any other Audition(s)):

1. Click on https://npfinancials.com.au/npf-capital-audition/

2. Please Click on “Start Trading” below the “Start-Up” Evaluation (or any other Audition(s))

3. Choose from the MT4 or MT5 platform

4. Click “Add to Cart” at the bottom right-hand corner

5. Click View cart at the top right-hand corner

6. Proceed to checkout.

7. Fill in your details and complete the process.

8. Leave Account creation as empty and put Coupon Code as “NPF-P10” to avail 10% Discount.

After you complete the above process, you will receive 2 emails from us: 1 for your MT4 or MT5 Login Credentials and the other email for your Trading Dashboard details. That’s how your journey to wealth begins.

>>BONUS: Join this month and you also get a FREE membership to one of our paid Trader Discord Rooms where we discuss intraday, market-open, 4-hour-swing, 12-hour-swing, end of day trades, inter-market analysis every day LIVE.

What to expect from the Audition?

The Rules for our Audition, are simple:

1. A stop-loss is required for each trade.

2. All positions must be closed on Friday at 4 PM Eastern Standard Time.

3. You must place a trade at least once every 30 days.

To Pass (target 10%) our Audition, we only ask you to follow our 2 drawdown rules as below:

1. Daily Drawdown: 4%

2. Maximum Trailing Drawdown: 5%

Apart from these 2 rules, we do not impose any other rules to follow.

Ready to become an NPF Funded Trader, trade our capital, and keep 70% of the profits.

>>Start here and claim your bonus today: https://npfinancials.com.au/npf-capital-audition/

Need more support?

We are always there to support you when you need it the most, either through Email, Live Chat, Landline phone, Mobile phone, WhatsApp, Messenger, SMS, Telegram, and Discord.

We recommend visiting https://npfinancials.com.au/faq/ for answers to the most common question we get.

If you can’t find your query in our FAQ, you can always contact us at +61 3 9790 6476 or [email protected] or WhatsApp at +61 425 183 642.

>>Apply today by clicking: https://npfinancials.com.au/npf-capital-audition/